Introduction to Line 15000 to the Canadian Tax Return

When tax season rolls close to in copyright, Just about the most normally requested questions is, what exactly is line 15000 on tax return sorts? even though Many of us rush to complete their taxes making use of software program or employ professionals, handful of just take time to comprehend what Each individual line basically means—In particular significant types like line 15000 tax return. when you’re thinking in which is line 15000 on tax return, you’re not by yourself. This line tends to confuse Canadians, especially Considering that the CRA modified its line quantities in 2019, replacing the earlier line 150 with line 15000.

So, what exactly is line 15000 on tax return paperwork all about? Line 15000 is your profits whole prior to any deductions. It encompasses almost everything from money from employment, hire, financial investment money, pensions, and perhaps some Added benefits. It is far from so simple as it Seems, but many taxpayers are not fairly certain exactly where to search out line 15000 on tax return types or what to expect.

If You are looking at your T4 slip and pondering where by is line 15000 on T4 2023, you need to know that the T4 is a component of contributing to this line but won't basically exhibit it. Rather, totals from quite a few slips are amassed from the T1 common return less than line 15000 tax return.

it is vital to be familiar with this line—not just for reporting, but will also for figuring out eligibility for various government programs. This section addresses the topic, but We'll continue further more in precisely what is line 15000 on tax return and how it impacts you in the subsequent area.

Breaking Down the objective of Line 15000

Now that you just understand about the issue: what on earth is line 15000 on tax return, We'll examine what this line definitely signifies. In basic phrases, line 15000 is your revenue overall prior to your deductions are subtracted. This sum includes every type of taxable source income including wages from work, profits from self-employment, desire, dividends, hire, pensions, and so forth. Grasping the indicating of line: what is line 15000 on tax return is significant, as it impacts a lot of financial determinations.

So, why can it be relevant? Your line 15000 tax return amount serves as The premise that govt companies use to determine your eligibility for varied packages and benefits. for instance, GST/HST credits, outdated Age Security (OAS) clawbacks, and copyright youngster reward calculations are all based upon this sum. It is also often asked for by banks and lenders as Portion of credit rating assessments.

you could possibly however be inquiring, wherever is line 15000 on tax return varieties? you'll find it on the T1 common return. But keep in mind, should you’re inquiring wherever is line 15000 on T4 2023, you gained’t see it immediately. alternatively, revenue out of your T4 (like that proven on line 10100 tax return) is coupled with other resources to work out the road 15000 tax return whole.

Also, steer clear of mixing this with Web money, which displays afterward the tax sort. Line 15000 is your gross total—before deductions which include RRSP payments or union fees.

So, another time a person asks you what exactly is line 15000 on tax return, you'll are aware that it's not merely a number—It truly is an important gauge of your cash photograph.

the place to seek out Line 15000 on Tax Return sorts

lots of Canadians struggle with knowing exactly where line 15000 shows up on their tax return documents. no matter whether submitting through the old-school paper procedure or throughout the CRA's online System, discovering line 15000 is crucial to getting an precise and complete tax return. Even with initiatives with the CRA to make the tax submitting system less difficult, deciphering the road quantities can continue to be hard.

to reply in a simple manner: line 15000 tax return reveals up in your T1 standard income tax return sort. For anyone who is publishing a printed copy, you will discover line 15000 on the summary portion of the T1, by the heading "complete cash flow." This sum is the entire of various sources of income, including employment money, pensions, dividends, and so on. will not get it baffled with line 10100 tax return, which essentially describes work cash flow only.

if you are getting ready your return utilizing tax program or viewing your return on the internet by way of CRA's My Account, line 15000 is reported straight from the income summary. but nevertheless, numerous inquire where is line 15000 on T4 2023? It can be a daily confusion. The T4 will not likely Screen line 15000; having said that, it's going to Display screen figures, like employment money in box fourteen, necessary to determine line 10100, which then impacts the road 15000 calculations on your own return.

getting an concept of wherever is line 15000 on tax return forms lets you appropriately verify your money and assistance financial loan or govt plan purposes with assurance.

the connection amongst Line 15000 and Line 10100

Most taxpayers locate themselves baffled among line 15000 tax return and line 10100 tax return—and not without having cause. They each demonstrate up with your tax return and therefore are revenue-relevant, but they've varying purposes. as a result, let's demystify and reveal the difference between what is line 15000 on tax return and what's line 10100 on tax return.

to get started on, line 10100 tax return represents your employment earnings only. This consists of your income, wages, commissions, bonuses, and taxable Gains—all commonly present in box 14 of one's T4 slip. If you’re utilized and receive a T4, this line will demonstrate the income you've got earned from that job.

Conversely, what is line 15000 on tax return? This is often your Over-all money, which don't just contains your work income (from line 10100) but additionally any self-employed profits, rental earnings, pension profits, EI Added benefits, and the like. that's, line 15000 tax return is the whole of all of your resources of revenue just before deductions. which is why remaining aware about exactly where to Identify line 15000 on tax return sorts is very important—it completes the complete image of the fiscal position.

If you're asking yourself exactly where is line 15000 on T4 2023, the reaction is: it isn't. Your T4 has many of the knowledge (for line 10100) but would not exhibit line 15000 for every se. you'll need to look at your accomplished T1 return to locate the road 15000 tax return amount of money.

Having this website link is essential to have the ability to file precisely and to determine profit entitlement.

widespread errors When Using Line 15000

even though important, several taxpayers come upon line 15000 tax return errors. Not realizing precisely what is line 15000 on tax return may end up in inaccurate tax returns, advantage miscalculations, or bank loan software problems. Let's explore the most typical line 15000 tax website return errors and the way to reduce them.

Just about the most Repeated faults is mixing up line 15000 tax return with net income. Despite the fact that they seem synonymous, line 15000 is gross earnings prior to deductions. Web profits, located on the independent line, deducts these kinds of factors as RRSP contributions, union dues, and childcare expenditures. Inaccurately reporting This could impact your Positive aspects and tax credits eligibility.

Another mistake is imagining your T4 demonstrates line 15000. Taxpayers usually surprise, exactly where is line 15000 on T4 2023?—although the T4 only displays work money, not General earnings. Only your T1 basic return reveals line 15000, so be careful when applying it for varieties or money applications.

folks also get it Incorrect when mixing resources of earnings. When you are self-used, obtaining rental earnings or investment income, you have to report all of them to make your line 15000 tax return total appropriate. Omitting just one supply may perhaps induce penalties or reassessment.

at last, typical confusion exists concerning line 10100 tax return and line 15000 tax return. Even though line 10100 forms a component of the whole profits, it excludes other sources. just take treatment to really know what is line 10100 on tax return And the way it sorts a part of the overall revenue.

Steering clear of these typical errors tends to make your line 15000 tax return accurate As well as in conformity.

relevance of Line 15000 for Financial selections

figuring out what's line 15000 on tax return is not simply vital for tax return filing—its has true-earth implications for your finances. The figure demonstrated on line 15000 tax return is often used as being a benchmark by economic establishments, govt places of work, along with other companies to examine your economic predicament.

in the course of the appliance to get a home finance loan, bank loan, or rental house, lenders and landlords usually ask for the figure mentioned on line 15000 of the tax return to estimate your volume of earnings balance. This determine demonstrates your gross profits right before deduction, delivering a greater plan of your respective General earning ability. it really is therefore important to find out exactly where to find line 15000 on tax return, notably when preparing for major monetary decisions.

precisely the same relates to authorities Added benefits. Benefits such as the copyright youngster gain (CCB), GST/HST credits, and Old Age protection (OAS) dietary supplements generally have line 15000 applied to determine eligibility. If you're wondering what's line 15000 on tax return underneath the scope of benefit qualification, the response is straightforward: it's the starting selection on which your entitlements are calculated.

it truly is equally crucial that you know how line 10100 tax return is extra to line 15000. comprehension what is line 10100 on tax return can help you correctly compute work earnings, which will be coupled with other resources like rental and investment decision profits to fill out your line 15000 tax return.

Misreading or misunderstanding this line may perhaps bring on missing alternatives. If you will purchase a house or apply for pupil assist, understanding exactly where is line 15000 on tax return types can help you in making improved fiscal options.

FAQ – What Is Line 15000 on Tax Return?

1. what on earth is line 15000 on tax return?

Line 15000 tax return is your Total profits before the deduction. What This means is always that it encompasses money from all resources—employment, self-employment, rental properties, investments, pensions, and so on. In case you are inquiring about what is line 15000 on tax return, basically visualize it as the overall amount of every thing you made in the course of the tax year minus the deduction of any allowable expenditures or deductions.

two. exactly where is line 15000 on tax return types?

if you are planning a T1 basic tax return, line 15000 are going to be located in the profits summary part, normally at or close to the major of the first page from the summary. for anyone who is filling out your return on CRA My Account or tax application online, It will probably be very clearly marked beneath "overall income." So, the answer to where by is line 15000 on tax return depends upon how you're accessing your return, but it’s constantly listed as your overall money determine.

three. ways to get line 15000 on tax return on-line?

when you finally are logged in to CRA My Account or tax software, your line 15000 tax return will be uncovered underneath the income breakdown or summary space. When you are continue to unsure, utilize the look for purpose while in the software to look for "line 15000" or "overall profits."

4. in which is line 15000 on T4 2023?

Many people mistakenly check with, where by is line 15000 on T4 2023. nonetheless, line 15000 doesn’t seem right on the T4 slip. The T4 presents your employment revenue, which reveals up as line 10100 tax return on your T1. Then, the quantity from line 10100 contributes to the total demonstrated in line 15000 tax return. So whilst the T4 is an element from the puzzle, it doesn’t consist of the entire reply.

five. Is line 15000 the same as Internet profits?

No, line 15000 is not equivalent to Web money. While line 15000 tax return implies complete gross cash flow, Web earnings is indicated additional under the tax return, after deductions like RRSP contribution, kid care expenditures, and union costs. Most authorities allowances and financial institutions demand both equally figures individually, and so, it's important to know what is line 15000 on tax return so as not to build confusion.

six. Can line 15000 be zero?

Certainly, it might be zero in the event you attained no earnings in that tax yr. this will come about for those who ended up unemployed and obtained no Added benefits or expense cash flow. having said that, if you did acquire any form of taxable revenue—even a small quantity—it can display up in line 15000 tax return. Be careful when reporting this, mainly because it influences eligibility for benefits, loans, and tax credits.

7. what's tax return line 10100, and How can it vary from line 15000?

Line 10100 tax return is profits from function only—particularly, Whatever you make from Operating for an employer, usually included in box 14 on your own T4 slip. When Other people inquire as to what's line 10100 on tax return, It truly is a smart idea to consider it just one bit of the earnings jigsaw. Conversely, line 15000 tax return is the overall revenue total, encompassing all sources, not restricted to work.

8. precisely what is so important about line 15000 for money uses?

Many monetary establishments check with your line 15000 selection from a tax return to qualify you for loans, home loans, or leasing. This determine is likewise referenced by govt solutions much like the copyright little one advantage and GST/HST credits to make qualifications. When you are Not sure where to search out line 15000 on tax return, please seek advice from your most current T1 or indication into CRA My Account.

recognizing what is line 15000 on tax return assists you in managing your taxes greater, entering into courses confidently, and also prevents expensive mistakes.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Patrick Renna Then & Now!

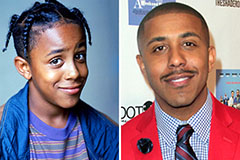

Patrick Renna Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now! Catherine Bach Then & Now!

Catherine Bach Then & Now!